Option Strategy Visualizer

2025A comprehensive Python-based tool for visualizing and analyzing financial options strategies with interactive payoff diagrams and algorithmic generation of all possible combinations.

A collection of my work in quantitative finance, systems programming, and computational research. Each project represents an exploration at the intersection of mathematics, finance, and computer science.

A comprehensive Python-based tool for visualizing and analyzing financial options strategies with interactive payoff diagrams and algorithmic generation of all possible combinations.

PDF document showing the MASM x86 assembly implementation that counts how many multiples of 11 exist between 0 and 1000.

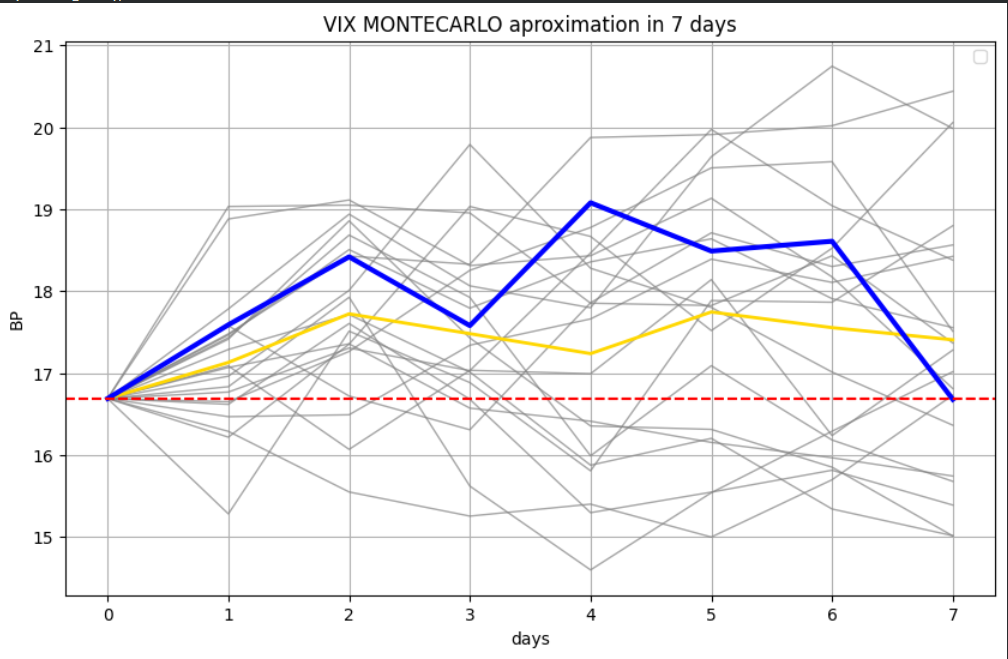

Quantitative research project applying the Ornstein–Uhlenbeck mean-reverting stochastic process to model and forecast VIX dynamics using maximum likelihood estimation and Monte Carlo simulation.

Valuation Toolkit is a modular, academically grounded collection of valuation methods for both early-stage startups and established firms. It includes multiple models—such as the Dynamic Dividend Discount Model (Dynamic DDM) for startups with no cash flows, Discounted Cash Flow (DCF), Gordon Growth Model, Market Multiples, Residual Income Model (RIM), and Adjusted Present Value (APV)—each with runnable Python code and corresponding academic papers for deep methodology reference.

I'm continuously working on new research projects in quantitative finance and systems programming.